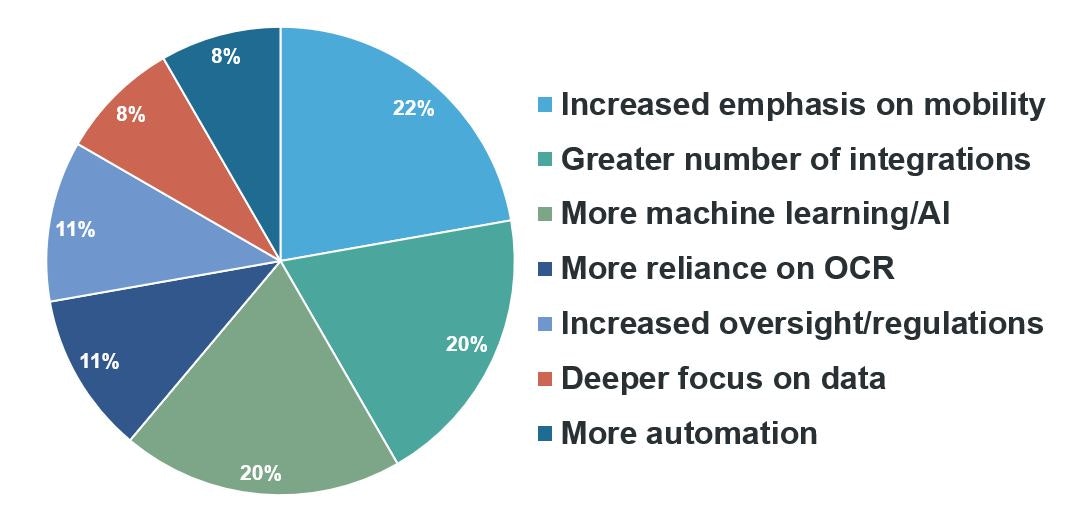

As the calendar year draws to a close it is an excellent time for reflection, but also an opportunity to look ahead to the coming year. At Chrome River, we are interested in what’s next for the expense automation industry in 2019 and beyond. To find out where our customers see the world of corporate expense management going, we asked them what their number one prediction is for expense management in the coming year. Their responses are noted in this chart, which gave us valuable insight to make a few top predictions for the year.

Even more mobility

Mobility has become the overwhelmingly most-desired capability of expense management solutions. As companies become increasingly global, and employees use their mobile phones for more and more business functions, they expect to be able to do anything on their phone as they can on a desktop. With this, we’ve placed a major emphasis on ensuring that our users can benefit from the full Chrome River experience, regardless of the device they are using. Thanks to our responsive design and web app approach, business travelers can easily create, submit and approve complex expense reports from their phones. Not only is the functionality identical, but it also delivers the same user interface, so users don’t need to learn how to navigate a mobile app, which may look significantly different to the desktop version.

Another prediction – a greater reliance on optical character recognition (OCR) – also ties into the increasing focus on mobility. Travelers who quickly snap a photo of a receipt in a restaurant and upload it to their expense solution don’t want to have to go back into the system in order to correct information that’s been incorrectly extracted by the OCR system. Thankfully, the OCR of today is a far cry from early systems, and receipt reading accuracy is now often beyond 95%, especially when used in conjunction with a credit card that is matched to the solution.

Even more impressive is that thanks to advanced technologies like Google Vision, OCR systems can look at, for example, a restaurant chain’s logo at the top of a receipt and identify the merchant. OCR continues to be a major focus for Chrome River, and we continue to add new language capabilities, so our users can benefit from this capability wherever they go.

More integrations and machine learning capabilities

Integrations and machine learning both fit into the category of “make life easier for me,” and can drastically reduce the amount of manual input required for expense reports, from receipt submission to data management. We’ve seen a significant focus on integrations that streamline the end-user experience over the past year or so, and now travelers can have transactions from merchants such as Uber, Lyft and SpotHero automatically flow directly into their expense wallet, without the need for a single click. These direct integrations will continue to become more important, and will allow business travelers to further reduce the effort needed for them to create expense reports.

Integrations are equally as important on the back end of the expense solution. For example, linking corporate cards to the expense platform are incredibly helpful both for expense entry (through real-time notifications), as well as reconciling card statements with expense reports, as we expect to see even more, deeper integrations with card providers, both in the U.S. and overseas in the coming months.

Although machine learning and AI are still somewhat in their infancy in the expense automation industry, there are several areas where this may become more prevalent in the coming years. Greater ability to assign expense GL codes based on previous submissions, and smarter categorization of expense types are both areas that could benefit from machine learning, and could further reduce the number of clicks needed to submit a report.

Learn more: Intelligent Automation with Chrome River Autobot

More oversight and regulations

The past year has seen several major stories on regulations and employer oversight of expenses. The recent Tax Cuts and Jobs Act led to some significant changes in the way that employees can deduct as expenses, while on the corporate level, there have been several high-profile, expenses-related stories from major organizations.

Whether it’s governments and tax authorities across the globe constantly updating expense-related regulations, or the need for organizations to avoid embarrassing news stories about expense fraud or submission of highly inappropriate business expenses, expense management solutions will continue to play a major role in enabling and enforcing compliance.

As more organizations have a greater overseas workforce, finance leaders can expect greater scrutiny of their expense reimbursement and tax reclaim processes around the world. As such, they will need to ensure that their expense solutions are configured not only to support these requirements, but are also kept updated as regulations change. Similarly, organizations are finding that expense-related snafus are becoming major PR issues, so the ability to detect and prevent potentially fraudulent expense submission, and deeper data analysis and auditing capabilities will therefore become even more important.

Learn more: IDC Presents 6 Emerging Innovations in Expense Management

We’ll take a look in 12 months and see if these come true. Regardless of what predictions come to pass, Chrome River will remain at the forefront of innovation.

Search

Subscribe

Latest Posts

- The Future of Finance: 5 Predictions For Digital Transformation in 2022 And Beyond

- Worried About Business Fraud? Use This B2B Pandemic Payment Fraud Checklist

- 5 Reasons Why Finance & Procurement Work Better Together

- Measure What You Manage: How to Make The Case for AP Automation With ROI To Your CEO

- A Brave New World: 3 Ways for Finance Teams to Navigate the Post- Pandemic Landscape

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.