A recent study showed that 80% of companies have been negatively impacted by the pandemic, with cash flow being a primary issue. Now more than ever, CFOs must embrace their new role as an architect of business value. Optimizing operational costs is key to that endeavor.

But to optimize costs, CFOs have to overcome common AP challenges and inefficiencies. Here are a few examples of some hurdles AP teams regularly deal with:

- 53% of organizations don’t have dedicated expense management software, according to an Emburse survey. Not having a dedicated, integrated system makes you less able to collect, store, and analyze financial data efficiently.

- 60% of CFOs lack visibility into transactions within their company, according to research from The Economic Intelligence Unit. A lack of transparency makes it hard to analyze spend and see where waste occurs. Unlocking the full potential of data analytics becomes near impossible.

- 90% of CFOs say manual workflow, errors, and a lack of automation are the main roadblocks to an efficient financial closing process. Repetitive, manual work is susceptible to human error and causes team burnout. It also prevents CFOs from devoting more time to strategic, high-impact initiatives.

At the end of the day, cash is always king. Businesses must find new ways to manage their cash flows better to survive black swan events, like the pandemic. This is why the CFO role will only become more complex and technologically demanding over time.

And as strategic automation and predictive analytics continue to drive better business decisions and new operational efficiencies, the controller’s role will only become more strategic, as well.

To help optimize spend and boost profits, CFOs should work closely with their controllers to increase financial visibility, improve margins, and unlock growth across their organization.

Why CFOs and controllers should get together

Strategic collaboration between the CFO and controller can create business value.

Here, we’ll cover three topics every CFO should discuss with their controller. By discussing these topics, organizations can realize numerous business benefits:

- Unlock and fully utilize the controller’s knowledge of day-to-day accounting operations for the entire finance team.

- Uncover new ways to help the controller, as well as accounting, payroll, and AP teams so that finance is operating at maximum efficiency.

- Discover actionable insights that help optimize spend, cash flow, and profit margins (and even discover new avenues of growth)

1. How to optimize the closing process

Closing the books—and ensuring every entry is correct and legitimate—is an important, detail-oriented task. Analyze your financial closing process with your controller and answer the following questions:

- Are you making too many manual journal entries? As an Emburse Executive Paper notes, “Turning paper-heavy, manual financial processes into virtualized online processes with real-time data extraction from images, smart approval workflows, and sophisticated analytics capabilities can transform organizations and their finance teams.”

- Are simple errors, missing receipts, and other AP mistakes common? Bad data can cost you a ton of money. According to Autodesk, bad data may have caused $1.8 trillion in global losses for the construction industry in 2020.

- What tasks can we automate? Automation saves time and money. The CFO of Levi Strauss attests that automation of tedious tasks can save businesses 30-40% of the time previously spent.

What the CFO and controller can do

After taking inventory of journal entries, work with your controller to optimize every step of the process. First, standardize everything by streamlining responsibilities and tasks. This will eliminate any unnecessary bottlenecks in the workflow.

Second, automate whatever you can. For instance, you could ditch spreadsheets with cloud-based expense management and AP solutions. In fact, 46% of companies have been able to switch over to a centralized, cloud-based expense management system in less than a year, according to Emburse research.

Third, store documentation with manual entries. This way, when auditors inquire about a transaction from months ago, you can immediately pull up accurate information.

Finally, work with your controller and auditors to uncover meaningful insights about the closing process. See what exceptions they’re uncovering, review accounting policies, and discuss how to group key transactions together.

This one-time effort will reduce questions and objections during all future audits. It will also give you valuable external feedback to improve policies and implement operational efficiencies.

2. How to improve spend compliance

Look at these statistics compiled by Compliance Next:

- In 23% of cases, corporate fraud causes more than $1 million in losses.

- Companies that discover a data breach within the first month spend about $1 million less compared to those that discover a breach later.

- 29.3% of fraud stems from an internal lack of controls, and the average corruption case incurs a $200,000 loss

Simply put, non-compliance can derail your business. As a CFO, your controller is a valuable asset to identify and minimize risks, since they have eyes and ears on daily operations and every transaction flowing through your organization.

What CFOs and controllers can do

CFOs and controllers can work together to improve compliance monitoring, minimize expense-related risks, and ultimately make the business more sustainable:

1. Have a robust risk framework

Identify the most important sources of risk, such as compliance with GDPR, SOC-II, or ASC 606 regulations. Non-compliance can cost you dearly. For instance, Google, Marriott, and British Airways have all been fined more than €10,000,000 for GDPR violations.

As a CFO, you should give your controller a leadership role in developing strategies to limit risk exposure and ensure compliance, especially in local jurisdictions where laws and standards may vary. This can add tremendous value to your enterprise.

2. Improve risk management focus & resiliency

Deloitte researchers have pinpointed areas of compliance and risk management where enterprises can boost resiliency, especially during times of uncertainty (like the COVID-19 pandemic). These include improving and overcoming challenges with:

- Credit risk management

- Third-party risk management

- Cybersecurity risk management

- Data risk management

The plan you and your CFO develop should include clear duties, checkpoints, and stress testing. Also, conduct regular risk reviews (i.e., trust but verify)

3. Automate & streamline compliance

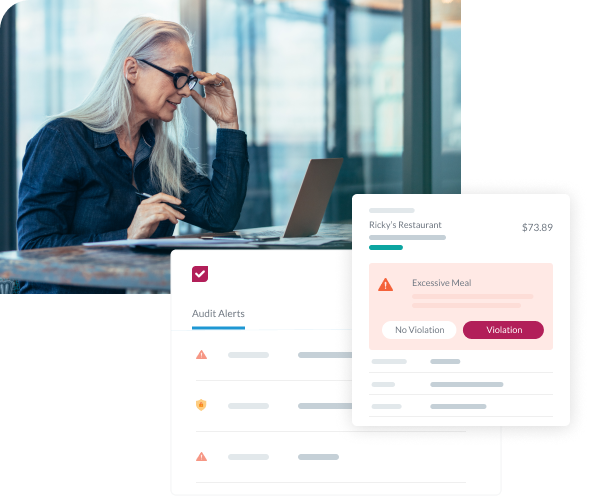

Stop scouring through Excel sheets to ensure compliant transactions. Cloud-based platforms, such as Emburse Audit, leverage predictive data analytics, smart automation, machine learning, and AI to automatically enforce your policies and flag problems while you’re sleeping. This protects your business and your bottom line.

With the right auditing software, the CFO and controller have a tool to catch non-compliance more effectively. For example, potential fraud will get automatically flagged to your controller.

3. How to integrate financial data and operating metrics

You’ll need a full picture of your AP operations to identify meaningful trends, leakage, and opportunities for improvement. If you’re still relying on spreadsheets or outdated expense solutions that are still 50% or more manual labor, you probably aren’t able to gather or analyze data the way you should.

One survey found that 49% of CFOs believe disconnected data, overuse of spreadsheets, and manual processes are the greatest challenges their finance teams have to overcome. In fact, US and UK businesses lose $140 billion annually because of disconnected data, according to SnapLogic research.

By merging operational metrics with financial information, CFOs can get a fuller picture of their business expenses. But gathering and analyzing the right data requires the help of the controller, with their unique visibility into financial operations and cash flows.

What the CFO and controller can do

CFOs and controllers should always collaborate if only to implement a unified, transparent, and organization-wide reporting system. Eliminate needless waste and drive meaningful, data-driven business decisions:

- More insights and opportunities: Enhanced visibility means you can see clearly where you’re wasting money and where you’re missing revenue opportunities. With their unique perspective on enterprise performance, controllers are a great resource.

- Adoption of new technology: You’ll need advanced expense management and AP software to get the most out of data integration and real-time analytics. Decide whether it’s time to upgrade your existing solution with your controller’s input.

- A single source of truth: Say goodbye to duplicate or missing data. With a unified platform, you don’t have to waste time reconciling reports. Get to what matters: spend analytics and data-driven decision-making.

Imagine seeing a snapshot of your company’s financial health in a single, shared dashboard.

CFO and controller collaboration is a key driver of business value

When you combine traditional financial statements, such as income and cash flow statements, with operational metrics like customer acquisition cost and churn rates, you are able to arrive at a clearer view of how your business is doing financially.

This empowers both CFOs and controllers to make better strategic decisions, improve operations, and unlock new growth opportunities that can lead to sustained financial success.

Of course, even if CFOs and controllers work together, they’re still handicapped by the tools they use. If you’d like to see how Emburse can help create lasting value at your company, we’re ready to answer your questions:

Get My Finance Team On The Same Page ➔

Search

Subscribe

Latest Posts

- The Future of Finance: 5 Predictions For Digital Transformation in 2022 And Beyond

- Worried About Business Fraud? Use This B2B Pandemic Payment Fraud Checklist

- 5 Reasons Why Finance & Procurement Work Better Together

- Measure What You Manage: How to Make The Case for AP Automation With ROI To Your CEO

- A Brave New World: 3 Ways for Finance Teams to Navigate the Post- Pandemic Landscape

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.